📊 Banking Tech in Mexico

Traditional giants are facing competition from dynamic new challengers.

Welcome to Latinometrics. We bring you Latin American insights and trends through concise, thought-provoking data visualizations.

Thank you to the 130 new subscribers who have joined us since last week!

A few weeks ago, we asked if you liked the format of a shorter, one-topic newsletter. Most of you answered yes.

So, as 2023 draws to a close, we’re trying out something new (why wait until the new year?). Starting this week, you’ll receive 2 weekly editions from us (on top of the Domingo Brief). In each of these, we’ll discuss a singular topic but devote more attention to it.

Sound good to you? Not at all? As always, let us know by simply responding to this email or leaving a comment. And don’t forget to check out the comment of the week!

Mexico’s Banking Industry 💵 💶

Longtime Latinometrics readers – intelectuales, as we call them – will know that we once called Brazil the banking capital of Latin America.

We stand by that assessment, given that five of the region’s biggest banks are based there. But don’t think for one second that Mexico’s banking sector is any less dynamic.

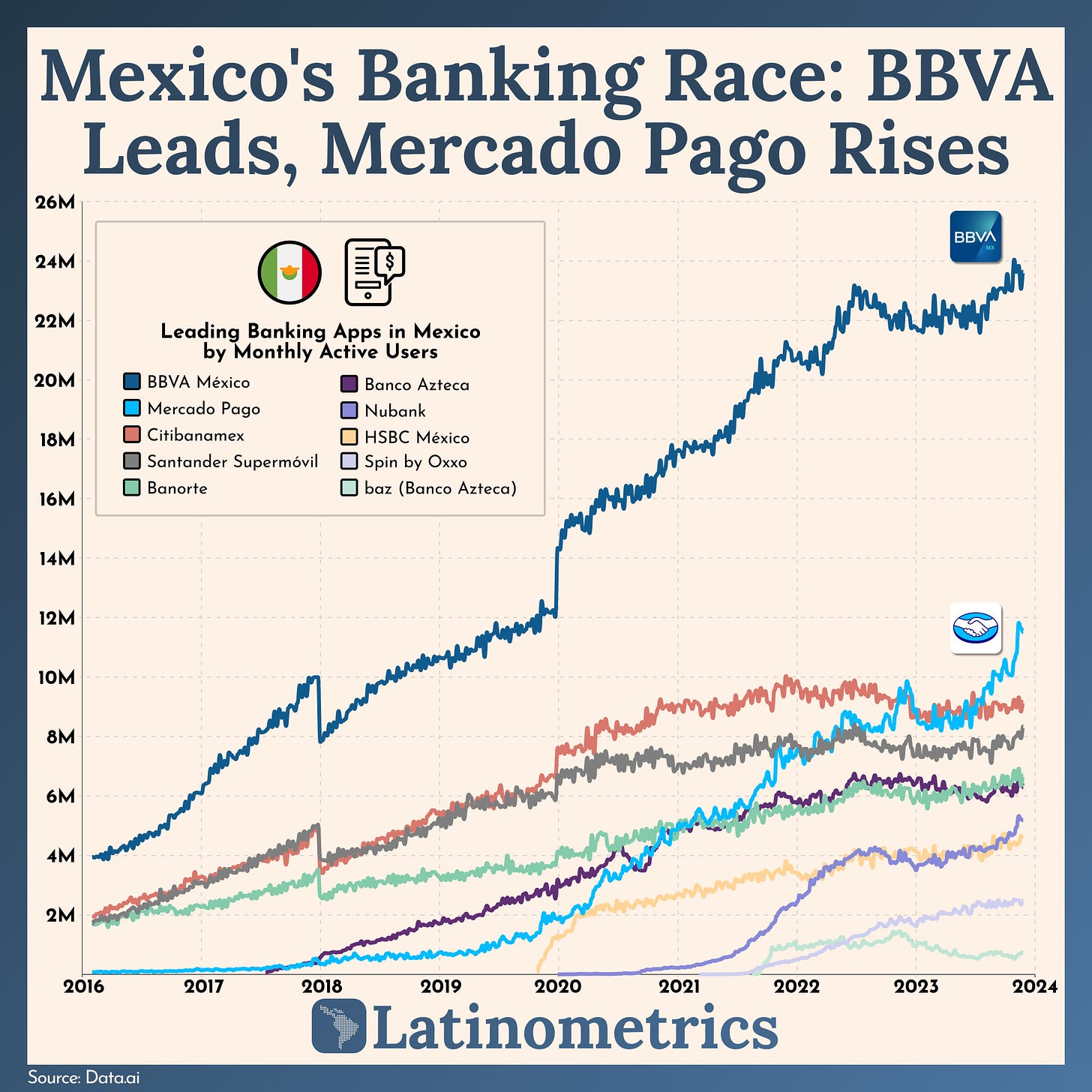

Indeed, it’s been a few exciting years for Latin America’s second-largest country, particularly as crises and newcomers have shaken up the traditional finance industry. Looking at the last eight or so years, we turned to data.ai to get updated figures on banking apps sorted by the number of users in Mexico.

You probably recognize the global and traditional giants like Santander or BBVA. The latter of these has long been the major player nationally as far as banking apps go, counting an ever-growing sixth of Mexico’s total population among its active users.

However, innovation is usually driven by fresher faces, and this is true for nobody more than Mercado Pago, the fintech offering of Latin American retail giant Mercado Libre. Originally serving as an escrow designed to protect marketplace payments, the application has since become a one-stop shop for all banking needs, offering key products such as their digital wallet.

Mercado Pago, which started in Argentina just over 20 years ago, has made its way across Latin America and now found a prosperous home in the region’s northernmost country.

Most recently, it became BBVA’s most credible contender in terms of monthly active users in Mexico. In the second half of this year, it surpassed Citibanamex, a gigantic bank with $84B+ in assets, as the 2nd-most used banking app in the country.

Mercado Pago’s app has quintupled its Mexican fanbase since 2017 to 10M active users, in the process displacing eighteenth-century Old World juggernauts such as Santander. And if our charts are any indication, it’s not slowing down anytime soon.

So, if you look at the current ranking and think, Wow, what a gap, we’d recommend you not count out younger banks like Mercado Pago. We’ve been experiencing a post-pandemic digital banking boom, and we bet BBVA will have some company at the top soon.

—

That’s all for this week 👋

Comment of the Week 🗣️

This week, Francisco Padilla calls out the case of Argentina, which to most sounds like a troubled country, but according to the UN’s HDI is “Very Highly Developed.” From our HDI chart on LinkedIn.

Join the discussion on social media, where we’ll be posting today’s charts throughout the week. Follow us on Twitter, LinkedIn, Instagram, or Facebook.

Feedback or chart suggestions? Reply to this email, and let us know. 😁