Welcome to Lachinometrics. We bring you Latin American insights and trends through concise, thought-provoking data visualizations.

This week, we’re changing things up a bit with our 1st-ever themed issue: 3 stories, all surrounding one topic. And the topic? Well, how about the world’s 2nd-largest economy?

We’ve written about China in the past, and there’s a reason: the country is hugely important for Latin America’s economic growth. This week, catch a look at some of our China-focused charts! Sorry in advance if today’s issue sounds a lot like this.

Thank you to the 358 new subscribers who have joined us since last week!

Today's charts 🇨🇳:

Whatever happened to Chinese financing in LatAm?

Brazil’s trading relationship with China

Where are all those remittances going?

Make sure you check out the comment of the week at the bottom!

China’s Loans 💴

Let’s imagine for a second that you run a Latin American country, and you’re interested in building a hydroelectric dam or a windfarm. Due to economic instability, you’re unable to secure sufficient credit from traditional sources such as the Inter-American Development Bank or World Bank. Where do you turn?

Easy. Ask China.

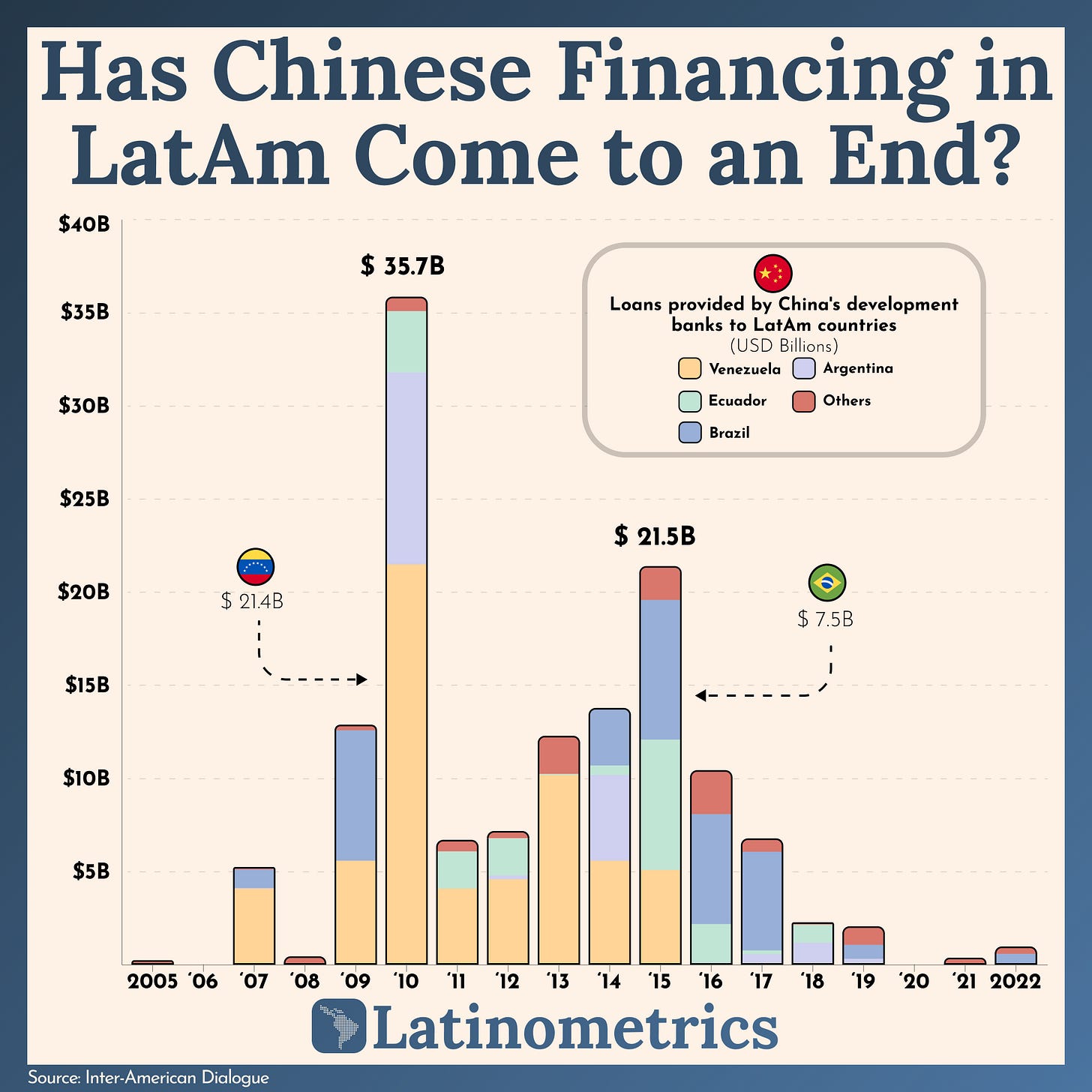

Since 2005, China’s two largest development finance institutions have provided over $138B in financing to Latin American countries, particularly in the energy and infrastructure sectors. To give you an idea of the scope of that much money: it’s more than the entire GDP of Ecuador.

Just about half of all Chinese money went to one country. Venezuela received roughly $60B in loan commitments between 2007 and 2015, loans they arranged to pay for with oil exports. Unfortunately for both parties, Venezuela’s production plummeted starting in the 2010s, and so China has refused for years now to loan the country any more money.

Other major oil producers, Brazil and Ecuador, round out the top 3 destinations, receiving $31B and $18.2B, respectively since 2007. Meanwhile, Argentina has financed some major infrastructure projects—such as railways and metro lines—with the $17B it borrowed from China.

Overall Chinese lending to the region peaked in 2010 with $35.1B in loan commitments. There’s since been a noticeable drop in recent years, including 0 new loans in 2020 and only about $1B lent total in the last two years.

It’s also worth noting that key countries such as Chile, Colombia, and Uruguay have not received major financing like their neighbors. Others, like Mexico and Peru, borrowed very little relative to their size.

The reason for this is simple: with the exception of Brazil, all of the countries that turned to China for significant financing in the 2000s had bad reputations among international lenders, owing to either economic instability or government policy. So unlike leaders in Chile or Colombia, they couldn’t access traditional multilateral loans, leading to them turning to China as a lender of last resort. As Venezuela’s case showed, this didn’t always work out, perhaps explaining China’s more cautious approach to financing in recent years.

In any case, over the last 15 years, China has shown itself to be a major partner for Latin America’s economic development—one more than willing to put up the money when needed.

China Loves (Brazilian) Soy 🇧🇷

Keep reading with a 7-day free trial

Subscribe to Latinometrics to keep reading this post and get 7 days of free access to the full post archives.