Welcome to Latinometrics. We bring you Latin American insights and trends through concise, thought-provoking data visualizations.

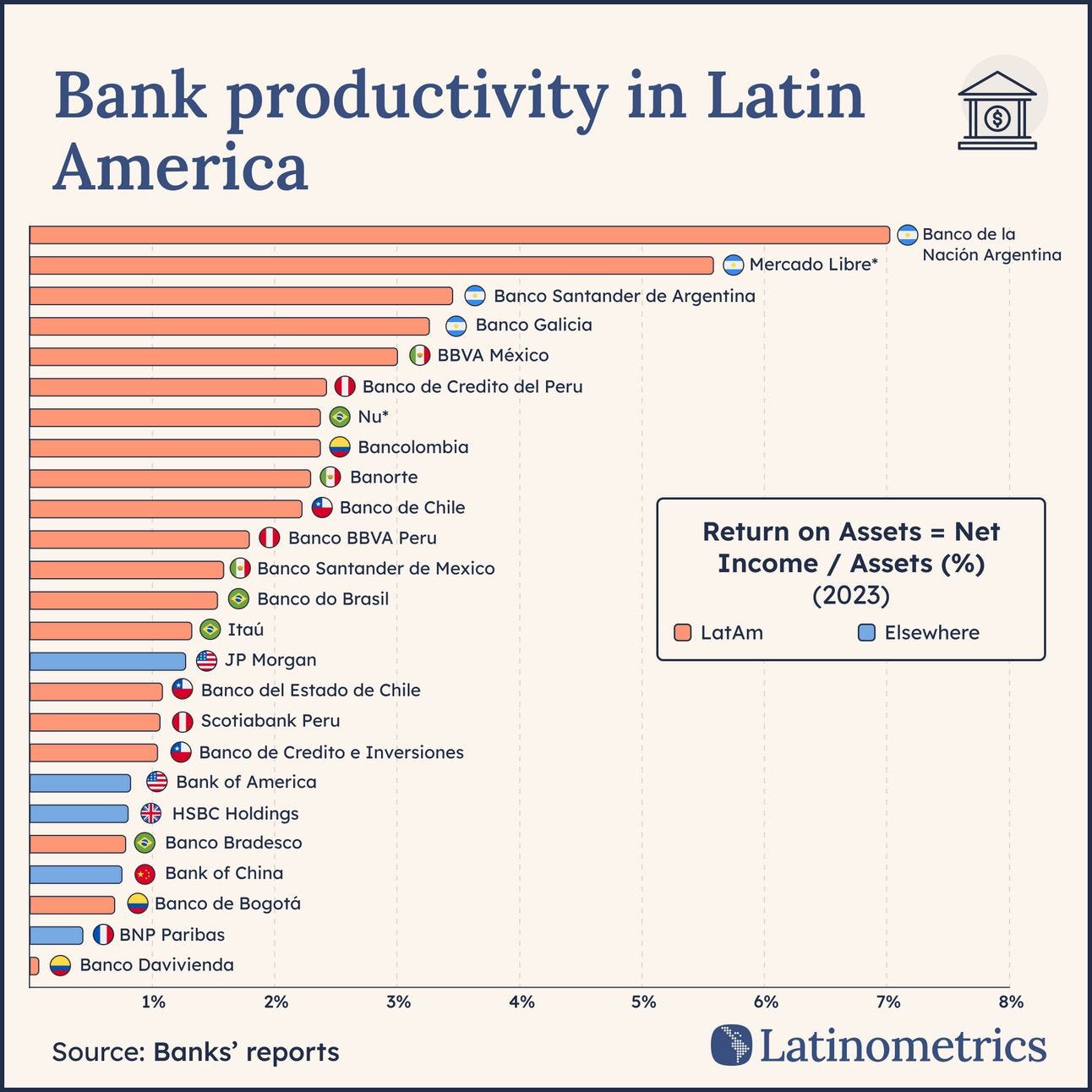

Today's story might be a bit dense, so hang in there with us. We're examining the productivity of Latin American banks, specifically through dividing profits by total assets to calculate the return on assets (ROA) of the region’s key banks.

In other words: how much profit can banks generate with what they manage?

Let's take the region's largest bank, Itaú, as an example. As we reported a few weeks ago, the bank manages a whopping $556B in assets. Last year, its operations generated $24B in revenue (roughly the equivalent of the entire GDP of Armenia), of which $7B was profit for the bank.

Divide that $7B by the total $556B in assets, and we see that Itaú generates profits equivalent to 1.33% of its total assets in a year.

Now that we've established what we're doing here, let's take a look. For fun, we added Mercado Libre and Nubank, the region's most valuable fintech firms, into the mix.

Bank productivity in Latin America

Argentinean banks top the list. The country's largest, Banco de la Nación, outpaces every other bank we examined by more than double.

Founded in 1891, Banco de la Nación is the largest public bank in the country. It was established to stabilize the economy after a financial crisis and has since played a vital role in supporting agriculture, industry, and commerce. The bank provides credit to businesses and individuals, focusing on rural and underserved areas.

Naturally, we were curious to take a peek under the hood. We compared Banco de la Nación's balance sheet with that of Banco Galicia (Argentina's largest private bank).

Subscribe to Premium Subscription to read the rest.

Become a paying subscriber of Premium Subscription to get access to this post and other subscriber-only content.

Upgrade Translation missing: en.app.shared.conjuction.or Sign In