💷 Foreign Investment

Latinometrics will be in Miami next week! The World Strategic Forum will feature Latin American heavyweights like Vicente Fox, Iván Duque, Juan Guaidó and many big-name executives. We’ve partnered with the host, IEFA to offer our subscribers 30% off regular price tickets! Make sure to use the link below to get the discount.

Welcome to Latinometrics. We bring you Latin American insights and trends through concise, thought-provoking data visualizations.

Foreign Investment 💷

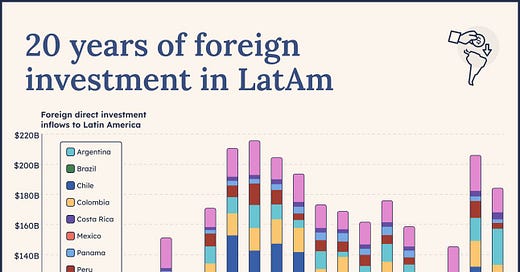

Foreign direct investment (FDI) has been instrumental to Latin America’s growth over the last two decades.

In fact, the commodities boom which kicked off the 21st century served to attract growing investment inflows to large regional economies like Brazil and Argentina.

20 years of foreign investment in LatAm

Foreign companies can use investment to boost productivity and economic growth, contribute to technological spillovers, and even reduce unemployment through the creation of both direct and indirect jobs. All the while, this investment can allow for greater participation by recipient countries in global value chains.

The Economic Commission for Latin America and the Caribbean (ECLAC) produces an annual report on FDI within Latin America. Despite a 9% year-on-year decrease in total FDI inflows to the region, some countries saw growth over the previous year. Argentina and Chile received respective increases of 57% and 19%. Meanwhile, Costa Rica’s impressive 28% growth is worth applauding, as the country’s investment promotion agency PROCOMER managed to attract record-breaking figures of over $3B.

In 2023, the largest foreign investors in Latin America remain the United States and European Union, which are responsible for 33% and 22% of total inflows respectively. Despite the headlines, China’s investment has actually shrunk as of late, though it’s too early to know if this would become a lasting trend.

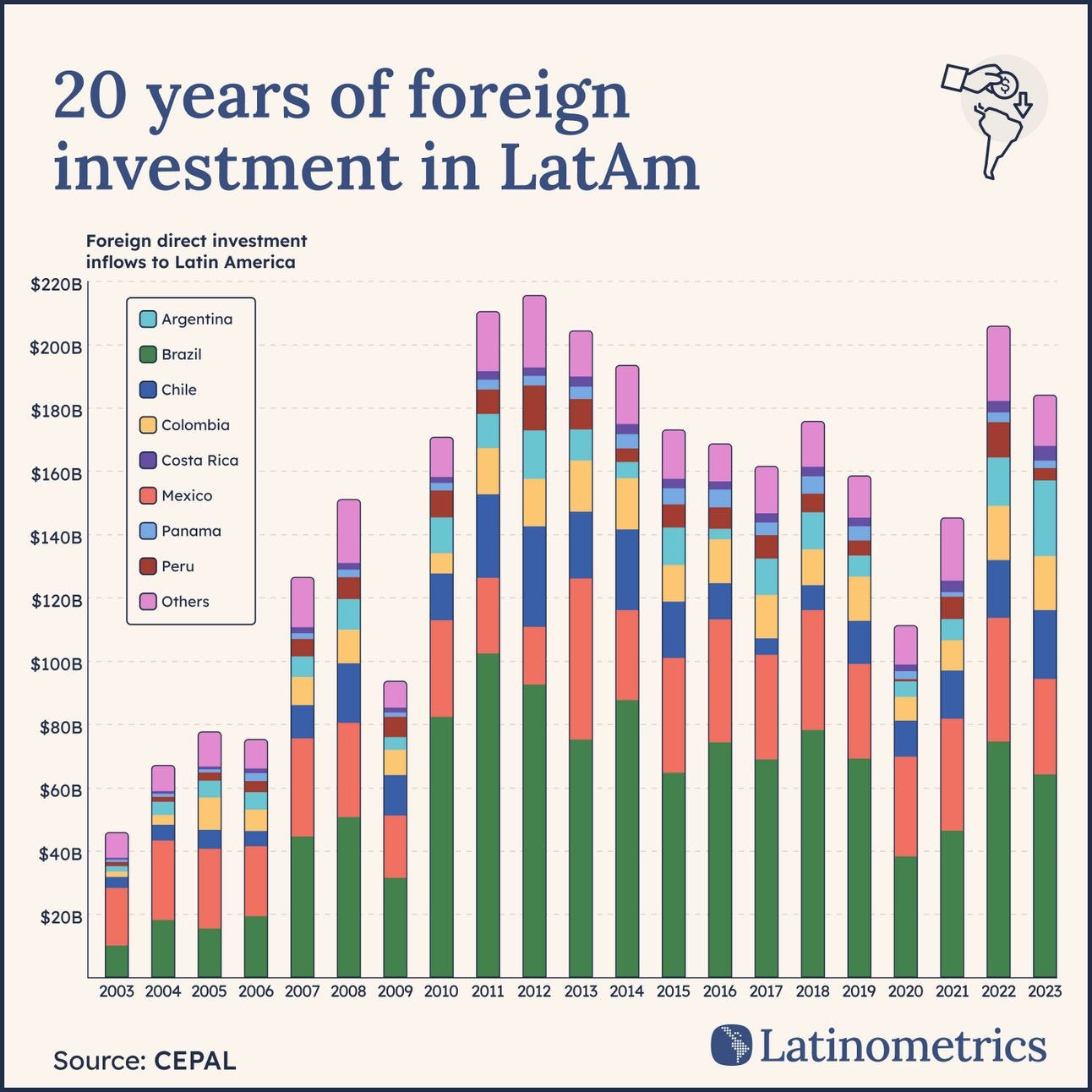

Investors in Latin America now bet big on services

Nonetheless, both ECLAC and the International Monetary Fund (IMF) have expressed concern about Latin America’s slow growth in recent years. The region seems marked by socioeconomic tensions, inflation, and underemployment, issues which require long-term thinking to address.

Foreign investment can be one tool for Latin America’s development. Given the region’s natural resource endowments and cheap labor costs, local governments should focus on industrial promotion policies and other strategies to move up in global value chains.

Comment of the week 🗣️

Victor breaks down his thoughts on Brazil vs. Argentina fiscal spending policies.

Feedback or chart suggestions? Reply to this email, and let us know!

Join the discussion on social media, where we’ll be posting today’s charts throughout the week.