Remittance Dependence 📊

For many Latin American economies, remittances from abroad play a vital role.

Welcome to Latinometrics. We bring you Latin American insights and trends through concise, thought-provoking data visualizations.

Today, let’s take a look at remittances: who’s sending money, where to, and with which implications. To do so, we’ve teamed up with our friends at Inter&Co, a financial super-app which helps to facilitate international transfers.

Remittances 💸

The economies of Latin America are powered by many things: soy, beef, oil, t-shirts, flowers, and so on. But for many countries in the region, the most important source of financial flows is not trade, or foreign investment, or even overseas development aid.

It’s dollars from the diaspora.

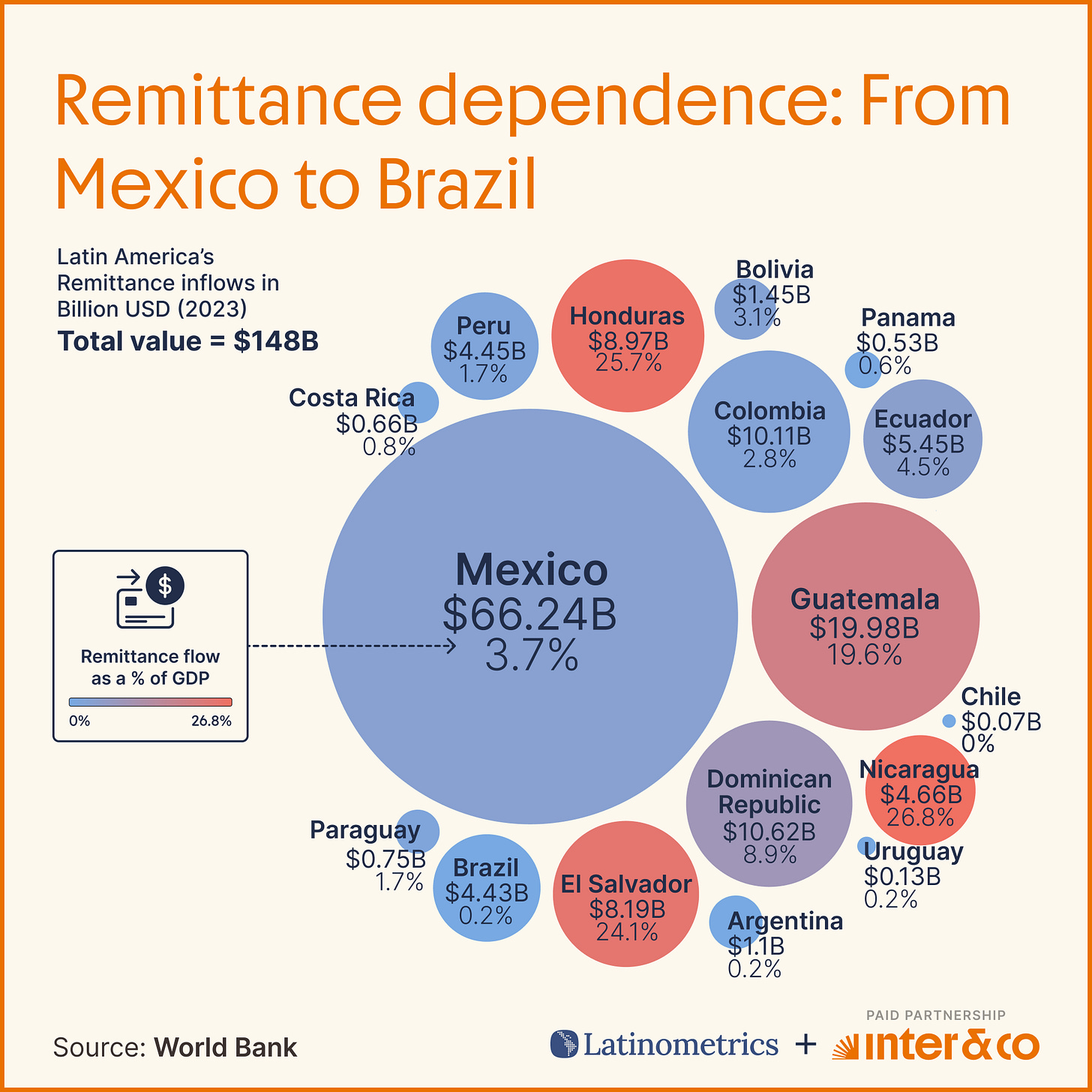

Remittances, or money sent by migrants back to their home countries, form a critical piece of the Latin American economy. Mexico is actually the world’s second-largest destination for remittances, behind only India, as the millions of Mexicans in the United States (and elsewhere) sent home over $66B last year.

To give you an idea, that’s larger than the entire economy of some Latin American peers like Honduras or Paraguay. And yet, given Mexico’s massive, dynamic, and highly-diversified economy, remittances still only represent less than 4% of the country’s gross domestic product (GDP).

Contrast this with countries like Nicaragua and El Salvador, where remittances make up over 25% of the national GDP. Yes, you read that right: for these small Central American countries, migrants living abroad – particularly in US cities like Miami or Los Angeles – send in more money to their families than any one industry or export.

Evidently, the economies of these countries are just as connected as the people who move between them are. When droughts or recessions impact local communities in countries across Latin America, remittances from friends or family abroad are a key way of staying afloat.

And we’ve come a long way from the olden days where only a few options, namely Western Union, existed to process these transactions. Today the fintech boom has produced a number of great new options, like our partner this week Inter&Co, to help people get money to their friends and families as fast, smoothly, and cheaply as possible.

🚀Send money internationally with Inter&Co. Download the super app and make your transfers faster, cheaper, and easier. You can also check out their July promos on their Instagram profile.

Comment of the Week 🗣️

Daniel brings up the unique situation of small, tourist-heavy countries like the Dominican Republic which have such a substantial diaspora. There are over 2.5M Dominicans living abroad, of which over 92% live in the US, particularly in cities and neighborhoods like Washington Heights, Manhattan.

Join the discussion on social media, where we’ll be posting today’s charts throughout the week. Follow us on Instagram, LinkedIn, X, TikTok, or Facebook.

Feedback or chart suggestions? Reply to this email, and let us know! :)

Me llama la atención cuanto serán las remesas venezolanas