💰 Sovereign Wealth Funds

Today’s story is in collaboration with Fondo Latinoamericano de Reservas (FLAR) and IFSWF. If you wish to learn more about their research, you can do so here.

Sovereign Wealth Funds 💰

There’s no easy way to put it: Latin America really suffered during the height of the COVID-19 pandemic. Regional economies dried up as demand plummeted and the health crisis blocked supply chains.

In the midst of this, some local governments tapped an underrecognized resource in the form of state-owned investment funds known as sovereign wealth funds. For example, the funds of Chile, Colombia, and Peru each stepped in to allocate significant resources towards supporting their people in a time of need.

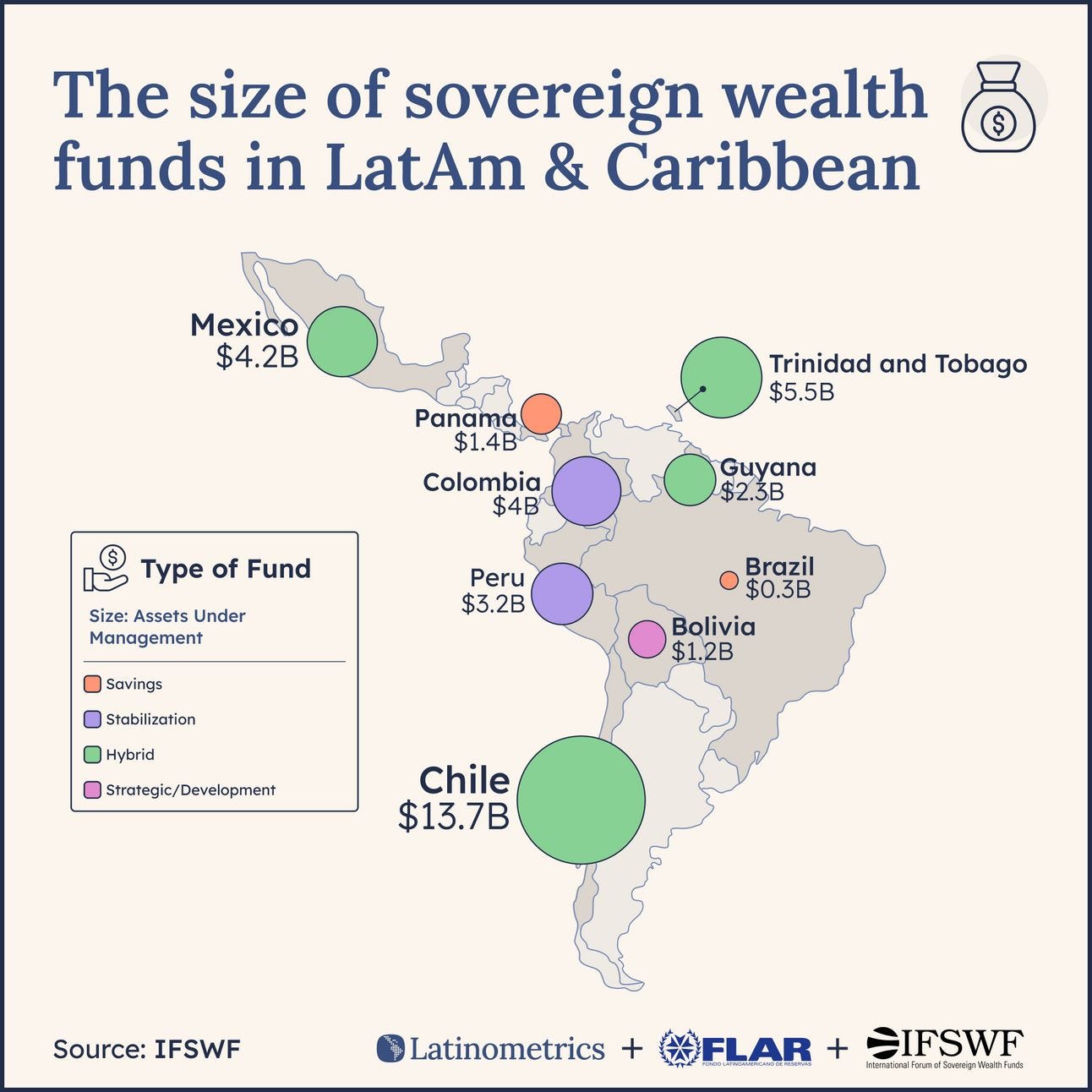

These countries aren’t alone, however. There are currently 12 sovereign wealth funds in Latin America, managing a total wealth of over $35B. Most of these funds are dedicated towards fiscal stabilization, which is handy during economic crises such as the one we saw in 2020.

The size of sovereign wealth funds in LatAm & Caribbean

However, while these funds enable governments to manage revenue volatility – by saving in the good years and helping out in tougher times – and ensure stabilization, they could do much more if they were also granted a development mandate.

After all, imagine if Chile could put part of its nearly $14B fund towards fighting inequality, boosting education, or just building a more solid foundation for the well-being of future generations.

But where would this money even come from? Many successful sovereign wealth funds, like those in Norway and Kuwait, are driven by commodity revenues. And wouldn’t you know it, Latin America is well-endowed in commodities.

Visualizing Latin America's mineral wealth

The pandemic experience should demonstrate that strategic investment funds can help finance sustainable development—but they’ll need help. Latin American governments have a unique opportunity to ensure their management of key natural resources – like nickel, copper, and lithium – takes into account national developmental needs.

After all, Latin America holds over half of the world’s lithium, while Brazil is a major player in rare-earth minerals and the nearly $42B global nickel market. The global energy transition is boosting the importance of each of these resources, which are critical for everything from lithium batteries to electric vehicles. So producers are subsequently attracting interest from external powers like China or the United States.

Local governments should take advantage of this interest, leveraging their natural resources to bolster their funds and deliver the growth and development their economies need.

To learn more about challenges and opportunities, check out this study from FLAR and the IFSWF.

Comment of the week 🗣️

Alfonso points his finger at the US as the culprit for access to capital for government spending.

Feedback or chart suggestions? Reply to this email, and let us know!

Join the discussion on social media, where we’ll be posting today’s charts throughout the week.